You can get new post notifications through RSS, email, Twitter or Facebook

Time for growth investing

I am hardly the first person to recommend switching to growth investing. There has recently been crop of strategists arguing that we are at the point in the cycle where growth is likely to out-perform, as economic growth returns.

I agree with these arguments, but there is little point in repeating them here.

I have two more arguments. I have always preferred a bottom up approach. Frankly, this is not because I am sure that bottom up investing is better than top down, but because I am better at it.

At the moment. many growth shares look like good value individually. A purely bottom up investor is likely to end up with a lot of growth shares.

My other argument is that value investing has become too popular. The evidence that value and income tend to out-perform has received a lot of attention. New approaches to value such as naked PE have been devised, and conservative value metrics such as the long term PE have become popular.

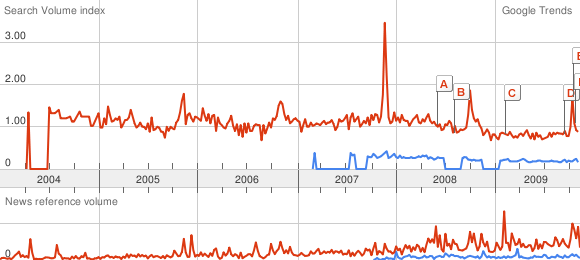

A look at this graph from Google Trends (which shows what people search for) shows what people have wanted to find out about for the last few years.

There has been consistent interest in value investing and very little in growth. As a general rule, what is popular is over-valued, and what is un-popular is under-valued. During the dotcom boom investors complete lost interest in value, and those did invest in value then our-performed. it appears that now, we have the opposite situation, as still-nervous investors have lost interest in growth.

Comments disabled

Sorry, comments are closed